About Me

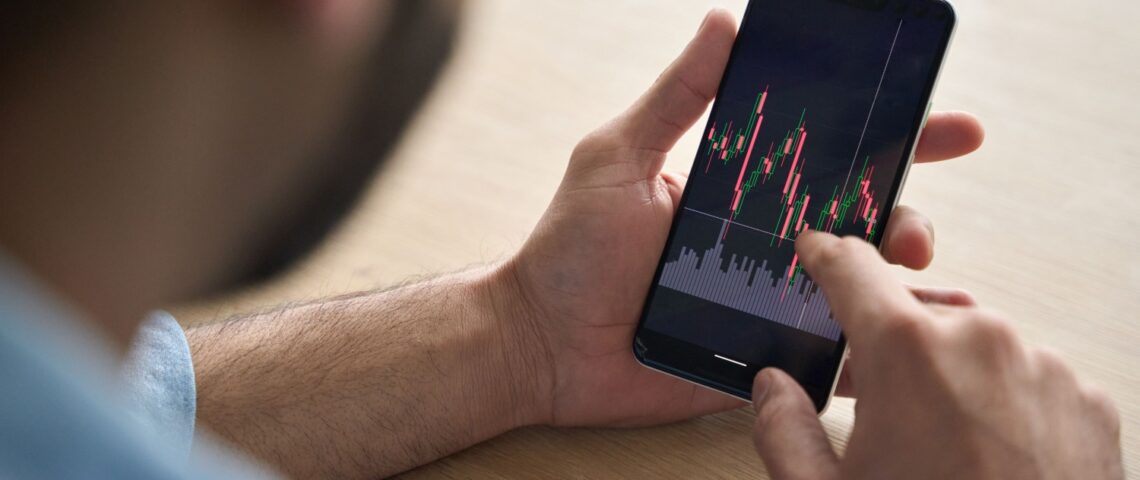

I’ve been advising clients for over 30 years.

In this time, I’ve garnered a broad base of knowledge helping clients from various walks of life and helping create financial solutions built specifically for them.

I’ve been advising clients for over 30 years.

In this time, I’ve garnered a broad base of knowledge helping clients from various walks of life and helping create financial solutions built specifically for them.